WE HAVE MAX CAPACITY OF 5 CLIENTS EACH MONTH

Take the First Step Toward Your CFA Journey

Build a Strong Foundation in CFA and Kickstart Your Career in Finance

The CFA Pathway & Fundamentals course is specifically designed to introduce you to the essential concepts and skills covered in the CFA (Chartered Financial Analyst) curriculum. This course will help you understand the core areas of finance, investment analysis, and portfolio management, enabling you to assess if pursuing the full CFA certification is the right career move for you.

Whether you're aiming for a career in investment banking, asset management, corporate finance, or other financial fields, this course provides the knowledge you need to build a strong foundation in finance and take your first step toward becoming a CFA professional.

Watch the Video Below to Learn More (PRESS 🔊 FOR SOUND )

Hit Play On The Video

You Only Have One Chance to Impress Investors - Make It Count!

Here's how our fundraising decks 3X investor interest

Without wasting time and money on trial and error

Watch the video below

Hit Play On The Video

Featured in:

Why Choose This Course?

CFA Foundation Knowledge: Master the fundamental concepts covered in the CFA Level I curriculum, including ethics, financial analysis, and investment valuation.

Career Opportunities in Finance: With CFA knowledge, you can pursue roles in investment management, corporate finance, private equity, and more.

Path to CFA Certification: This course is an ideal first step for anyone looking to pursue full CFA certification, giving you a clear understanding of the path ahead.

Practical Financial Skills: Gain actionable skills in financial modeling, investment analysis, portfolio

management, and financial reporting to succeed in the finance industry.

Flexible, Self-Paced Learning: Study at your own pace, on your own schedule, with access to expert-led resources and learning materials.

What You Will Learn

CFA Core Principles:

○ Explore the CFA curriculum’s key areas, including ethics, economics, financial reporting, corporate finance, and quantitative methods.

○ Understand how the CFA Code of Ethics and Standards of Professional Conduct apply to financial professionals.

Investment Valuation:

○ Understand how to value investments, including equities, bonds, and alternative investments.

○ Learn how to calculate present value, internal rate of return (IRR), and apply these concepts in real-world investment scenarios.

Ethics and Professional Standards:

○ Study the ethical frameworks that guide financial decision-making, including fiduciary duties and conflicts of interest.

○ Understand the importance of ethical conduct in building trust in the financial industry.

Financial Statement Analysis:

○ Learn how to interpret and analyze financial statements including balance sheets, income statements, and cash flow statements.

○ Master key ratios and metrics to assess a company’s financial health and performance.

Portfolio Management:

○ Gain a solid understanding of portfolio theory, including asset allocation, risk management, and performance evaluation.

○ Learn how to build and manage diversified investment portfolios.

Quantitative Methods:

○ Get introduced to statistical techniques and financial modeling used in investment analysis, including time value of money and regression analysis.

○ Learn the foundations of risk management and data-driven financial decision-making.

What You Will Learn

CFA Core Principles:

○ Explore the CFA curriculum’s key areas, including ethics, economics, financial reporting, corporate finance, and quantitative methods.

○ Understand how the CFA Code of Ethics and Standards of Professional Conduct apply to financial professionals.

Investment Valuation:

○ Understand how to value investments, including equities, bonds, and alternative investments.

○ Learn how to calculate present value, internal rate of return (IRR), and apply these concepts in real-world investment scenarios.

Ethics and Professional Standards:

○ Study the ethical frameworks that guide financial decision-making, including fiduciary duties and conflicts of interest.

○ Understand the importance of ethical conduct in building trust in the financial industry.

Financial Statement Analysis:

○ Learn how to interpret and analyze financial statements including balance sheets, income statements, and cash flow statements.

○ Master key ratios and metrics to assess a company’s financial health and performance.

Portfolio Management:

○ Gain a solid understanding of portfolio theory, including asset allocation, risk management, and performance evaluation.

○ Learn how to build and manage diversified investment portfolios.

Quantitative Methods:

○ Get introduced to statistical techniques and financial modeling used in investment analysis, including time value of money and regression analysis.

○ Learn the foundations of risk management and data-driven financial decision-making.

Career Opportunities After Completion

Investment Analyst: Evaluate investment opportunities for funds, banks, and financial institutions.

Financial Analyst: Perform detailed financial analysis and reporting, supporting decision-making for businesses or investors.

CFA Candidate: With the foundational knowledge from this course, you’ll be well-positioned to take the CFA Level I exam and continue your journey toward becoming a Chartered Financial Analyst.

Portfolio Manager: Manage investment portfolios and make strategic decisions on behalf of clients or financial firms.

Corporate Finance Analyst: Analyze a company’s financial health, perform budgeting and forecasting, and support strategic business decisions.

Who This Course is For

Aspiring CFA Candidates: This course is perfect for anyone planning to pursue the full CFA certification and wants to get a head start on the fundamentals.

Finance Professionals: If you’re already working in finance and want to deepen your knowledge in areas like investment analysis, corporate finance, or financial reporting, this course is ideal for you.

Students and Recent Graduates: Perfect for those with a basic understanding of finance, who want to specialize in investment management or corporate finance.

Career Changers: If you're transitioning from a different field into finance, this course will provide the foundational knowledge to help you make a smooth shift.

Earning Potential

Upon completion of this course, you’ll be prepared for a wide range of finance roles, with entry-level positions in finance starting at 20K-35K per month. As you gain more experience and pursue full CFA certification, your earning potential will increase significantly, with senior roles in investment management, portfolio management, and corporate finance offering competitive salaries of 40K-70K per month or more.

From Deck Design to Financial Strategy

We provide all-around business support for a complete view, strategic growth,

and meaningful connections.

Business Plan Development: Crafting tailored roadmaps for entrepreneurial success and sustainable growth.

Startup Business Planning: Analyzing market trends to develop impactful strategies for competitive advantage and market leadership.

Financial Planning: Navigating financial futures with personalized strategies for wealth management and security.

Market Analysis and Research: Analyzing market trends to develop impactful strategies for competitive advantage and market leadership.

Planning, Consulting & Strategy

Providing expert advice to optimize business operations, drive innovation, and enhance profitability.

Loan Business Plan: Designing comprehensive plans to secure loans and demonstrate financial viability to lenders.

Investor Outreach: Analyzing market trends to develop impactful strategies for competitive advantage and market leadership.

Fundraising: Analyzing market trends to develop impactful strategies for competitive advantage and market leadership.

Immigration Business Plan: Strategizing business objectives to support immigration applications and cross-border ventures.

Client Testimonials

Our clients have secured funding, expanded markets, and achieved business goals with our pitch decks. Here’s what they say:

⭐⭐⭐⭐⭐

Oren Keinan

Blockseed’s comprehensive pitch deck was key to securing funding for my global fitness marketplace.

Pawel Chrzanowski

They developed a detailed financial model and dashboard that optimized my e-commerce business.

Lizna Satchu

Their market research and financial projections made our on-demand spa service stand out to investors.

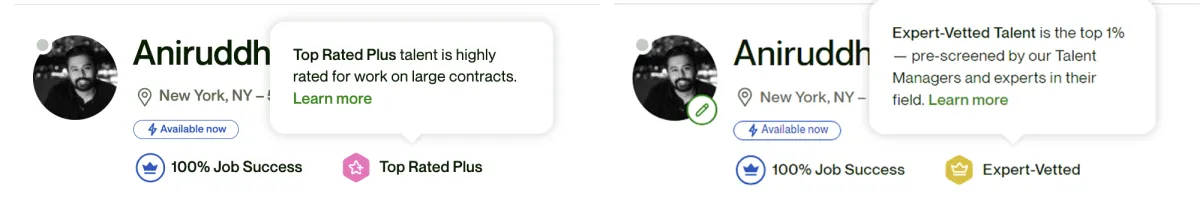

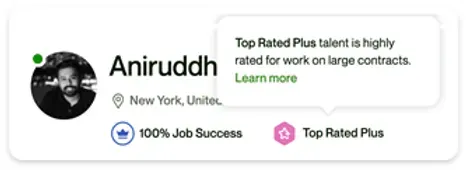

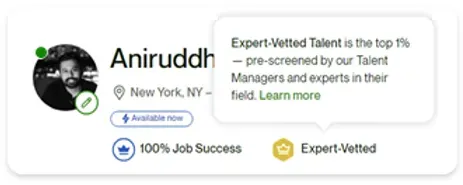

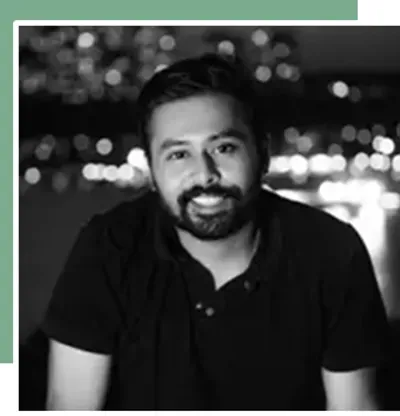

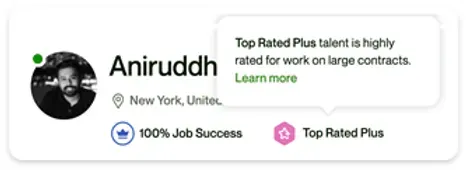

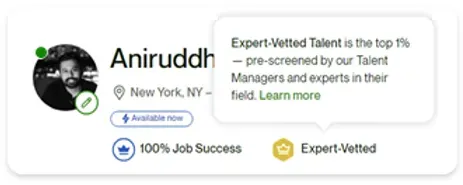

Hey, I'm Anih,

founder of The Scaleup Institute.

Creating a deck for your business is challenging... but it's not your fault.

After working over 8 years in top-tier Investment Banking, Management Consulting, and F500 firms...

I decided something HAD to change.

I have worked with several investment management companies, startups, and startup accelerators, helping them grow their business...

Got my degree from Columbia, ETH Zurich, and IIT Roorkee with a background in product design, economics, investment finance, and computer science...

Expert in

● Sales Strategy

● Marketing Strategy

● Investor Outreach

● Business Analysis

● Operational Management

● Project Management

● Financial Modeling

● Business Strategy

● Growth Modeling

● Startups

● Real Estate

● Project Management

● Financial Modeling

● Business Strategy

● Growth Modeling

● Startups

● Real Estate

Even after all this...

My first venture came out of MIT Media Labs and CamTech Hackathon in 2013, and was incorporated into a project in GE Labs, India.

I find joy and daily wage in helping other founders and I consistently raise for my Real Estate deals via my fund.

Love helping other founders - it's my hustle.

I've overseen pitches to 100s investors and successfully raised for my own Product business.

I’ve also been an advisor and mentor at IBM and Columbia University Accelerator and now I run our inhouse REPE firm.

Enroll Today and Start Your Business Operations Career

If you're ready to dive into the dynamic world of business operations and become an essential player in improving business efficiency, then the Business Operations Analyst Starter course is for you.

FAQs

What can I expect from the free consultation?

During the free 30-minute consultation, we’ll review your business needs, documents, and goals. You’ll receive actionable insights and a clear understanding of how we can support your journey to business success—no obligations attached.

How long does it take to complete a project?

Timelines vary depending on the package selected and the complexity of your needs. However, most projects are completed within 2–6 weeks, ensuring high-quality results delivered on time.

What makes your services different from other consulting firms?

We offer a full-service, results-driven approach tailored to your business needs. From financial modeling to investor-ready decks and strategic execution, we ensure seamless implementation and long-term impact—not just generic advice.

Can I customize a package based on my specific needs?

Absolutely! Our packages are flexible and can be customized to include specific services like investor outreach, operations setup, or ongoing consultation through a retainer package.

What industries or businesses do you work with?

We have extensive experience across diverse industries, including startups, real estate, e-commerce, and technology. Whether you’re launching a new venture or scaling an existing one, we have the expertise to help.

Expert Guidance from Industry Leaders, including Ivy League Graduates

Expert in

● Sales Strategy

● Marketing Strategy

● Investor Outreach

●Business Analysis

●Operational Management

●Project Management

●Financial Modeling

●Business Strategy

●Growth Modeling

●Startups

●Real Estate

Expert Guidance from Industry Leaders, including Ivy League Graduates

Expert in

● Sales Strategy

● Marketing Strategy

● Investor Outreach

●Business Analysis

●Operational Management

●Project Management

●Financial Modeling

●Business Strategy

●Growth Modeling

●Startups

●Real Estate

If you have received this communication in error or no longer wish to receive updates from BLSD Labs or any of its affiliated services—including BLSD Recruitment, BLSD Training, or BLSD Courses—please click the “unsubscribe” link provided; do not reply directly, as this inbox may not be actively monitored. For urgent or sensitive matters, please schedule a call via our online scheduler or send a tracked physical letter to ensure delivery and acknowledgment. This message and any attachments are confidential and intended solely for the designated recipient—unauthorized access, copying, use, or distribution is strictly prohibited. BLSD Labs and its affiliates provide staffing solutions, employee training, professional courses, and recruitment services on a best‑effort, advisory basis only; nothing herein constitutes licensed legal, financial, tax, investment, medical, or accounting advice, nor does it create any binding contract, offer of employment, or partnership unless formalized in a written agreement signed by an authorized representative of BLSD Labs. Informal discussions, emails, and messages are non‑binding. Outcomes vary based on implementation, timing, client readiness, and external factors; no guarantees of performance or success are made, and testimonials are illustrative only. To the fullest extent permitted by law, BLSD Labs disclaims all liability for any direct, indirect, incidental, consequential, or punitive damages arising from the use of, or reliance on, its communications, services, or materials; under no circumstances shall BLSD Labs’s total aggregate liability exceed ₹100,000 INR. All intellectual property created or provided by BLSD Labs—proprietary frameworks, tools, systems, templates, curricula, and internal assets—remains its exclusive property unless explicitly transferred through a signed agreement at project completion; client‑provided intellectual property remains the client’s property and will not be reused or shared without consent. In the event of non‑payment, refund requests, or chargebacks, any confidentiality or exclusivity provision is void, and BLSD Labs reserves the right to retain and repurpose all content and deliverables for internal training, portfolio demonstration, or public‑facing use. Any disputes, claims, or controversies arising from engagements with BLSD Labs shall be resolved exclusively through confidential, binding arbitration administered via a recognized digital arbitration forum (e.g., Presolv360, CADRE) under the laws of India, with venue in Indore, Madhya Pradesh; both parties waive rights to jury trial and class action. BLSD Labs is not affiliated with Meta, Google, Instagram, or any third‑party platform unless explicitly stated, and references to external sites are for convenience only and do not imply endorsement. No third‑party beneficiaries are created by this disclaimer. This disclaimer may only be amended by a written agreement signed by an authorized representative of BLSD Labs; if any provision is held invalid, the remainder shall remain in full force. Only agreements signed by BLSD Labs and the official policies published at www.blsdlab.com (including our Privacy Policy, Terms of Use, and Refund Policy) are enforceable.

Terms & Conditions | Privacy Policy | Copyright © 2025 The Scaleup Institute.

New York, United States